Contents

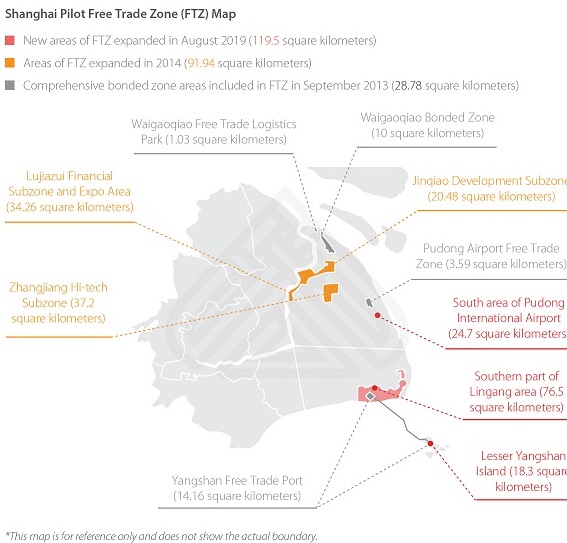

Founded in 2013, China (Shanghai) pilot free trade zone is the first batch of the only free trade zone in China, covering 8 areas. It includes Shanghai Waigaoqiao Free Trade Zone, Waigaoqiao Free Trade Logistics Park, Yangshan Free Trade Port and Shanghai Pudong Airport Comprehensive Free Trade Zone, Jinqiao Export Processing Zone, Zhangjiang High Tech Park, Lujiazui financial and trade zone and Lingang Special Area of the Shanghai Pilot FTZ.

Being consistent with global economic trends, it is a significant milestone that marks modern China’s determination to promote domestic reform and to expand its openness to the world. The main purpose of establishing this region is to explore new ways and new regimes to ensure effective and stable economic growth, to accelerate the transformation of government functions, and to promote economic restructuring.

Shanghai Free Trade Zone totally differs from Guangdong, Hong Kong, and Macao Free Trade Zone which is located in Guangdong.

The formal is famous an international and bilateral trade system, which focuses on the pilot on the financial reform, while the latter, is a national and regional free trade zone, focusing more on the foreign affairs, the economic ties of Guangdong with Hongkong and Macao, and economic integration of the Pearl River Delta region. This is the 20 National Development Zones in Shanghai.

Registration incentives provided for companies in Shanghai Free Trade Zone

Tax cuts and tax exemptions

- Tax exemptions: commodities between free trade zones and overseas destinations will be free from customs duties and import duties.

- Tax refund when entry: domestic commodities entering into the boned area, Shanghai Waigaoqiao Free Trade Zone, and Shanghai Pudong Airport Free Trade Zone will be considered as exporting, and the exporters here will enjoy tax refund.

- Exempt from business tax: tax exemption for international shipping, transportation, warehouse, international shipping insurance business income and income tax, tax exemption for registered companies in the Yangshan Deep-water Port Free Trade Zone.

- Tax refund for the commodities pass by: commodities departing from other countries’ ports transported to the overseas destinations by the Bonded Zone or Shanghai Pudong Airport Free Trade Zone halfway will enjoy the tax refund upon leaving the Bonded Zone or Shanghai Pudong Airport Free Trade Zone.

Port supervision

- Custom: companies registered in the free trade zone can collectively declare, the commodities imposed with the requirements to be transferred of waterways, aviation and railways will enjoy the optimal and simple customs formalities.

- Inspection and quarantine: commodity quarantine is preset. To further reduce the time-consuming and decrease the supervision procedures, imported commodities can be pre-inspected and pre-isolated at the time of entry.

- Foreign currency: foreign exchange verification has not been implemented in all regions, and foreign exchange value can be fully retained by the company. A flexible and convenient foreign exchange policy is preferred according to foreign exchange management measures in the bonded area.

Others

- The expansion of the scale of boned commodities: domestic and exporting commodities imported from, custom declared by Shanghai Waigaoqiao Free Trade Zone will be stored, processed or sold together with other bonded goods.

- Offshore account: to provide convenient financial settlement for overseas business, companies registered in the Yangshan Deepwater Port Free Trade Zone will have the right to open offshore accounts.