How Much is an Employee's Payroll in China?

GWBMA Payroll Calculator enables FIEs to calculate the cost of hiring an employee in China. The detailed results will provide you a detailed cost breakdown including the Individual Income tax charges as well as the employee and the employer’s corresponding social benefit contributions (social insurances and housing fund). GWBMA provides EOS (Employment Outsourcing Service) / PEO (Professional Employer Organization) Services Solutions in Shanghai.

If you set up a company in Shanghai, GWBMA provides the full HR for payroll service every month including salary disbursement, income tax deduction, and social security contributions. If you don’t have a legal entity in China, we also provide Business secretarial services and Outsourcing services for all employment-related matters including local employment contracts, payroll services, usage of certificate and chops, tax compliance, etc.

Tip: China’s IIT (Individual Income Tax law) reform introduced a host of changes to the system of individual taxation in the country last year. This payroll calculator is just the simulation tool, we strongly recommend you still consult a legal advisor. If you’d like to talk to one of our team, contact us here.

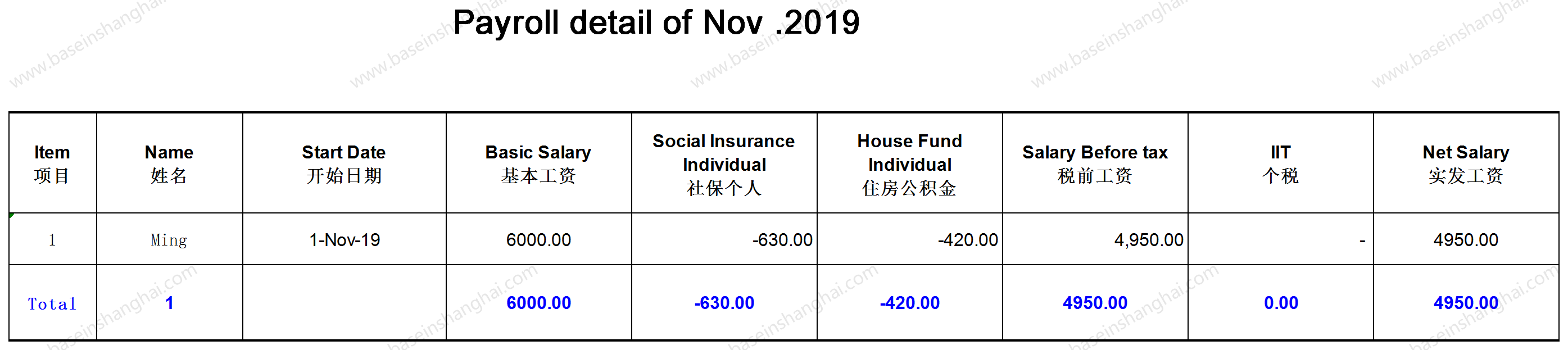

Employee Contribution

| Basic Salary | 0 |

| Pension | 0 |

| Medical | 0 |

| Unemployment | 0 |

| Housing Fund | 0 |

| Gross Salary | 0 |

| Individual Income Tax | 0 |

| Net Salary | 0 |

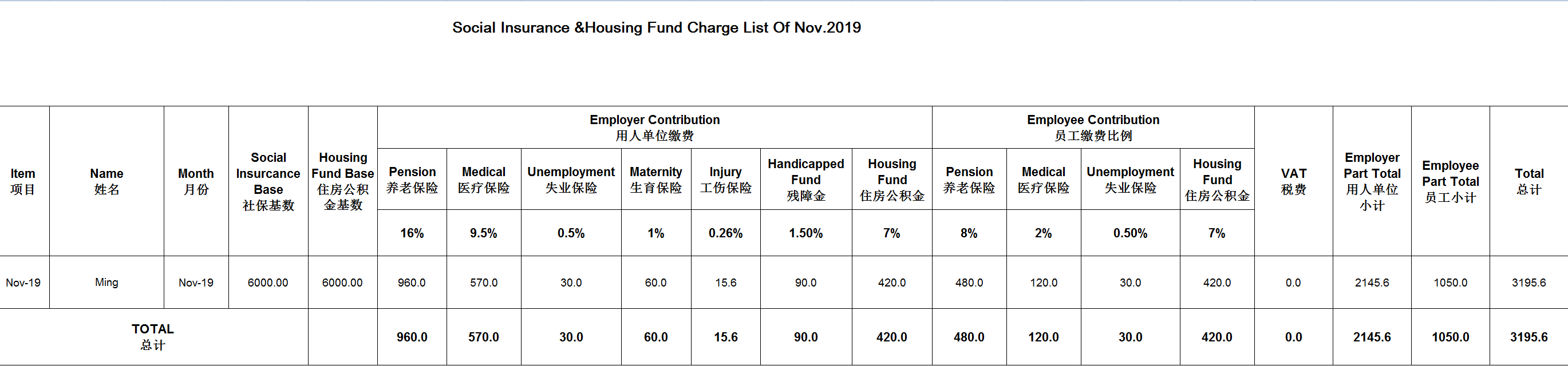

Employer Contribution

| Pension | 0 |

| Medical | 0 |

| Unemployment | 0 |

| Maternity | 0 |

| Injury | 0 |

| Handicapped Fund | 0 |

| Housing Fund | 0 |

| Employer Part Total | 0 |

| Total | 0 |